About Unihealth Consultancy Limited

Unihealth Consultancy Limited offers health services and is based out in the western part of India, Mumbai City. The service offering includes Hospitals, medical centers, consultancy services, supply and distribution of medicines, medical consumed drugs, and medical value travel. As per the consultancy project, it ( unihealth consultancy limited) is currently providing consulting to set up 300 + bedded health city in Pune, Maharashtra India.

Apart from India, Unihealth Consultancy Limited (UMC hospitals ) has 200 operating hospital beds across multi-specialty in Kampala, Uganda with a strength of 120 beds. UMC hospital with another name UMC Zhahir hospital situated in Kano, Nigeria has the strength of 80 beds. UMC Hospital has the capability for center providing different health facilities including a dedicated dialysis facility in Mwazana.

Unihealth has another vertical with the name ” Unihealth Pharmaceuticals Private Limited,” which is a subsidiary of the parent company. The company deals in exports and supplies their products largely to Victoria Hospital Limited (Joint Venture of Unihealth Consultancy Limited) in Uganda, UMC Global Health Limited (Joint-Venture of Unihealth Consultancy Limited) in Nigeria, and 114 Biohealth Limited (Subsidiary of Unihealth Consultancy Limited) in Tanzania. The company’s client strength and tele comes from countries like India, Uganda, Nigeria & Tanzania, Kenya, Zimbabwe & Angola and Ethiopia, Mozambique & DR Congo.

Unihealth Consultancy Limited IPO details and timelines

About the IPO, the IPO will start on September 8, 2023, and close on September 12, 2023. According to IPO details, the total issue size and fresh issue size for Unihealth Consultancy Limited is 4,284,000 shares. The lot size has been assigned to 1000 shares. Listing of stock will take place at NSE and SME. The company has a fixed price band of ₹126 to ₹132 per share.

The basis allotment issue date is set as Friday, September 15, 2023. In case shares do not get allotted date of refund is set as Monday, September 18, 2023. Shares will be credited to the Demat account on Wednesday, September 20, 2023, with the listing date decided as Thursday, September 21, 2023. For retail investors, the minimum investment would require around ₹132,000 since the minimum lot size of the share is assigned to be 1000.

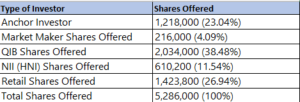

About holding, At present promoter has 95.32 % holding, and here are the details for OFS ( Offer for sell) :

Unihealth Consultancy Limited Fundamental Analysis

Company asset is growing steadily with good growth. If we track the company assets, the data from 2021, 2022, and 2023 are 5,838.87 ( INR Lakh), 6,478.95 (Lakh INR), and 7,833.32( INR Lakh) respectively. The company revenue in the current financial year 2023 is 4,603.01 ( INR Lakh) as compared to 3,792.69 ( INR Lakh) in the last financial year 2022.

Profit after tax stands at 768.00 ( INR Lakh) which is growing steadily year to year. The net worth of the company is around 2,612.83 ( INR lakh ). Debt of the company is 3,926.67 ( INR lakh)

Key performance indicator

ROE ( return on equity ) is 36.19%

ROCE ( return on capital employed ) is 20.99%

Debt to equity is 1.43

EPS ( earning per share ) is 6.94

Please refer to the below link for Unihealth Consultancy Limited RHP for complete details of the company :

Please refer to the below link to the DRHP Prospectus of EMS : ( Draft Red Herring Prospectus is documentation which helps in introducing new business or product to potential investors)

EMS IPO GMP: Grey Market price

For Grey market prices, please refer to the link below

Unihealth Consultancy SME IPO GMP Today, Latest Grey Market Premium. (topsharebrokers.com)

Disclaimer: GMP price is not the only parameter to confirm whether to invest or not to invest in an IPO. Please do your complete investigation before investing and read all documents carefully.

Status of the IPO Allotment:

To check the status of the allotment, please refer to the below link.

Bigshare Services Pvt Ltd (bigshareonline.com)